To illustrate the importance of defining cost objects, let’s consider an example. By defining cost objects for each product line, the company can determine the cost of producing each product, identify the most profitable lines, and allocate resources accordingly. This information helps the company optimize its product portfolio and maximize profitability.

Process Costing – Techniques Used to Allocate Costs to Cost Objects

- A manufacturing company that produces multiple products with different features and specifications.

- The organization also uses cost object information to plan and budget for its future programs and activities, and to align its resources with its mission and vision.

- From a managerial perspective, defining cost objects allows for better cost control and performance evaluation.

Moreover, it helps us to prepare an income statement for each product, segment, region, and so on. It will help the management to access each category’s performance across the whole company. They can boost the performance of the most profitable and shut down the low performance. Fixed cost is the cost that will occur regular basis regardless of the production quantity. The cost will remain the same over a period of months, quarterly and annually.

Which activity is most important to you during retirement?

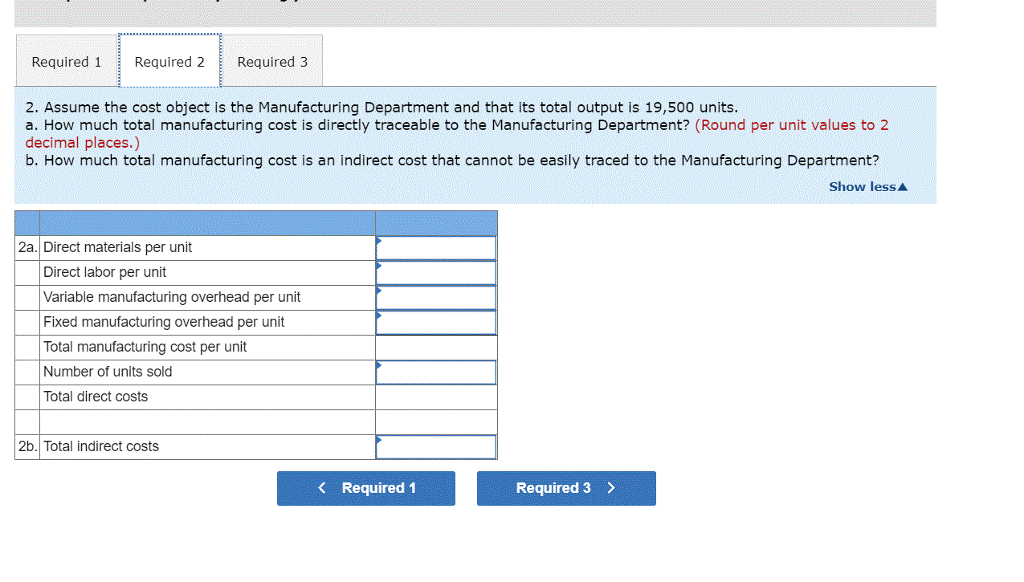

An example would be the person who runs the cutting machine in a print shop, or the paper for brochures that are printed. Identifying and correctly assigning expenses to cost objects increases the accuracy of financial planning and the analysis of historical costs against actuals. As we can see, the different methods to define cost objects can result in different costs for the same cost object, depending on the assumptions and criteria used. Therefore, it is important to choose the most appropriate download tax software back editions and updates method for the specific purpose and scope of the cost analysis, and to be aware of the limitations and implications of each method. Continuous monitoring of direct and indirect expenses provides valuable insights into the efficiency of business operations to identify areas for improvement and cost optimization. Direct costs need to be properly tracked, measured and valued so they can be correctly attributed directly to a specific cost object, such as a product, service or business unit.

Identifying Cost Objects – Challenges Businesses May Face

This can result in more cost objects, making assigning and tracking costs more challenging. However, larger businesses may also have more resources and specialized personnel to manage and allocate costs to cost objects. Standard costing is a method of allocation that assigns costs to cost objects based on predetermined standards or estimates. This method is often used in manufacturing companies that produce large quantities of identical products. Standard costing assigns costs based on the estimated cost of producing a single product unit.

The company also uses cost object information to evaluate its production efficiency and quality, and to implement continuous improvement initiatives. Another challenge businesses face when assigning costs to cost objects is allocating indirect costs. Indirect costs, such as overhead or administrative expenses, can be difficult to allocate to specific cost objects. Businesses may need to use allocation methods, such as activity-based costing, to allocate indirect costs to cost objects. A cost object is anything for which a separate measurement of costs is desired. It can be a product, a service, a project, a customer, a department, or any other unit of activity.

We will also discuss the challenges businesses may face when assigning costs and provide examples of cost objects used in the manufacturing industry. Direct and indirect costs are the major costs involved in the production of a good or service. It is worth noting that cost assignment is a general term for assigning costs, whether direct or indirect, to a cost object.

Fixed cost will not change based on the production while the variable cost will change depending on the number of production. The profit margins should be healthy enough to comfortably accommodate both direct and indirect expenses–and generate a net profit. Profit margins serve as a good measure of how efficient and profitable a company is at providing its products and services. To make the matter even more complicated, direct and indirect expense categories can vary among different industries and even within the same business. Cost management in these areas enables companies to make smart investments in marketing and service strategies. It supports decisions about which relationships to nurture and which might need reevaluation.

In the fast-paced world of early stage companies, time is a precious commodity. One of the most crucial decisions that a business can make is whether to expand into foreign… In the realm of business, the ability to effectively analyze and utilize lead data stands as a…

This information can then be used to determine the true cost of each bicycle and make more informed decisions about pricing, production processes, and resource allocation. Engines used in a Boeing 747 are easy to trace to each plane, and therefore the cost is easy to calculate. The salaries for marketing employees are easy to trace to the marketing department of a company. For example, a company is planning to eliminate an entire product line, and wants to understand which expenses will be terminated when the product line is shut down. The costs traceable to the product line include advertising expenses, a marketing specialist, a production line, and a warehouse. Cost is divided into direct and indirect cost in terms of degree of traceability to cost object i.e. product or job.

This cost may be directly attributed to the project and relates to a fixed dollar amount. Materials that were used to build the product, such as wood or gasoline, might be directly traced but do not contain a fixed dollar amount. This is because the quantity of the supervisor’s salary is known, while the unit production levels are variable based upon sales. Classify the following costs as (D) direct costs or (I) indirect costs in relation to a specific product. Direct costs can be easily traced to a specific cost object, such as a product or service.

Because direct costs can be specifically traced to a product, direct costs do not need to be allocated to a product, department, or other cost objects. Items that are not direct costs are pooled and allocated based on cost drivers. A non-profit organization that runs various programs and activities for its beneficiaries. This organization defines each program or activity as a cost object, and traces the direct costs of staff, volunteers, materials, and travel to each program or activity. It also allocates some indirect costs, such as administration, fundraising, and communication, based on a percentage of the direct costs or a cost driver. The organization uses cost object information to assess the effectiveness and impact of its programs and activities, and to report to its donors and stakeholders.