These costs cannot be avoided and so must be paid even when there is no revenue coming in. Common examples of fixed costs include rent, salaries, insurance, perpetual inventory methods and formulas and interest on loans. As businesses strive to reduce their overhead expenses, understanding which costs are fixed and which are variable is essential.

What Are Direct Costs? Definition, Examples, and Types

- For an accounting or law firm, it is easy to determine the number of hours and cost of working on a client because all staff is required to assign their time to clients throughout the work week.

- Since 2014, she has helped over one million students succeed in their accounting classes.

- These indirect costs can be traced to different production departments only by apportionment involving some formula or base which may not be 100% accurate and reliable.

- In practice, it is possible to justify the classification of almost any expense as both direct and indirect.

- Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

- Direct cost related with a product can be measured with a high degree of accuracy.

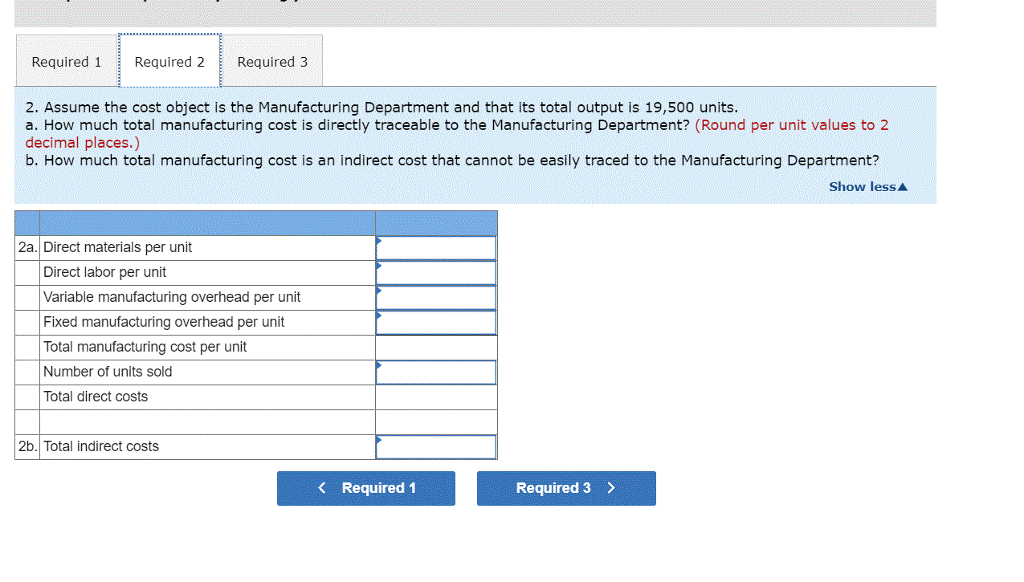

This helps a company to calculate the overhead cost per unit so that prices can be set accordingly to ensure a profit is made on each product even after incorporating all indirect expenses. Combined, direct and indirect costs represent all of the expenses incurred to run a company’s day-to-day business operations. With accurate cost allocation to cost objects, businesses can price their products just right – not too high or too low.

What are Traceable Costs?

Operational cost objects include everyday expenses like factory machines, labor, maintenance, supplies, and electrical power. Firstly, smaller businesses may have fewer cost objects than larger firms, as they may have a simpler organizational structure and product/service offerings. This can make it easier for them to assign and track costs, as there are fewer cost objects to manage. Cost objects can be used to track the cost of specific projects, such as new product development, process improvement, or facility upgrades. By understanding the cost of each project, manufacturers can make informed decisions about project prioritization, resource allocation, and project management.

Which activity is most important to you during retirement?

Manufacturers can also use cost objects to track the cost of materials and services specific suppliers provide. By understanding the cost of each supplier, manufacturers can negotiate better pricing, improve supplier relationships, and reduce supply chain risks. Cost objects can be used to track the cost of individual departments within a manufacturing facility, such as production, engineering, or quality control.

Great! The Financial Professional Will Get Back To You Soon.

ABC is a more sophisticated method of cost allocation that assigns costs to cost objects based on the activities that drive those costs. Accountants also benefit from using cost objects to track expenses in a business. Cost objects provide a more accurate picture of where money is being spent, which helps accountants create more accurate financial statements. This can help them comply with financial reporting requirements, such as GAAP or IFRS, and provide stakeholders with a clear view of the company’s financial health.

Cost objects help businesses reduce their costs by identifying areas where they may be able to streamline their operations or reduce waste. This information can be used to make informed pricing decisions, as the company can determine the actual cost of each product and adjust the price accordingly to maximize profitability. Cost tracing refers to the assignment of accumulated costs that have a direct relationship to a particular cost object. Supervisors at the Boeing plant are supervising employees working on several different projects, and it is impractical to track his or her time to each individual plane. Some materials are so insignificant that the cost of monitoring how much glue goes into a product outweighs the benefit of knowing the cost of glue per unit. From this analysis, you can directly attribute $2,020,000 in costs to the smartphone production and marketing and $360,000 in costs to the smartwatch production and marketing for the year.

One of the biggest challenges businesses face when assigning costs to cost objects is identifying the appropriate cost objects. Sales and marketing teams can benefit from using cost objects to track expenses by understanding the cost of acquiring new customers or generating new leads. Using cost objects, they can see how much money is spent on specific campaigns or initiatives and make informed decisions about where to invest their resources. Sales and marketing managers promote the organization’s products or services and generate revenue. They may assign costs to cost objects related to sales and marketing activities, such as advertising and promotions.

Variable costing is a method of allocation that assigns only variable costs to a specific cost object, such as direct materials, direct labor, and variable overhead. Operating and maintaining specific equipment costs can be tracked using cost objects. By understanding the cost of each piece of equipment, manufacturers can identify opportunities to improve equipment efficiency, reduce downtime, and optimize maintenance schedules. Businesses may face challenges in choosing the right allocation method when assigning costs to cost objects. Several different allocation methods are available, each with advantages and disadvantages.

Cost objects help businesses control costs by identifying the specific items or activities driving their expenses. By assigning costs to specific cost objects, businesses can track their expenses more accurately and identify areas where they may be overspending. By identifying and assigning costs to cost objects, businesses can gain insights into their operations, identify areas for improvement, and optimize their financial performance. However, it is essential to consider the challenges that may arise when assigning costs to cost objects and to review and update the allocation methods used regularly.

Cost analysis is the process of identifying, measuring, and allocating costs to cost objects. Cost analysis helps managers to make informed decisions about pricing, budgeting, profitability, and performance evaluation. In this section, we will discuss the importance of cost object in cost analysis from different perspectives. From a managerial perspective, defining cost objects allows for better cost control and performance evaluation.